Dividend Vault

How to Build a Stock Portfolio that Pays Increasing Dividends Year after Year

Financial Authors, Educators and Stock Investors

I am getting dividends!

We'll show you how to systematically build a portfolio filled with stocks that pay recurring and increasing dividends.

WeI'll walk you through the journey from a complete newbie to a savvy Dividend-Growth Investor who can manage a dividend portfolio in market conditions independently.

We'll share with you 40+ case studies of the best dividend stocks inside Dividend Vault after compilation of 1000+ of stocks’ annual reports in both Malaysia and Singapore.

What you are about to read could potentially change how you invest and how much you will have in your stock portfolio over the next 3-5 years.

Here's why ...

I want to reveal to you a Complete Strategy that I use to build myself a 6-Figure Stock Portfolio that is now bringing in 5-Figure Annual Dividends without stock tips and charting softwares. More importantly, this strategy that I use is best suited if you have zero knowledge or experience in the stock market.

I realised many people want to achieve financial abundance in life but they fail to build meaningful wealth in the stock market.

To make it worse, many had lost and are still sitting on huge capital losses that amount to 4, 5, or even 6-figures in Ringgit Malaysia.

Sure, it hurts to incur financial losses.

But, I believe the real damage is internal - Feeling stupid, losing confidence, bruising pride and ego ... etc. I feel you. In most cases, many choose to sweep these losses under their carpets - Out of sight and out of touch. For this reason, many believe that stocks are risky and they vow never ever to dabble in stocks again.

Before I figured this out, I thought that stock investing is risky, and it takes guts and luck to be profitable in it.

This belief arose when I was a primary schoolboy back in the 1990s. I noticed a peculiar behaviour where my relatives, especially my uncles, aunties, and elder cousins were deeply engrossed with lines of letters (stock counters) and figures (stock prices) projected on TV screens and newspapers.

‘What was that’ I asked.

And that was my first encounter with the stock market.

It has the power to dictate the emotions of my relatives. For instance, if a stock price increased, there would inevitably be some relatives who would be leaping for joy and others who would sigh in regret. At that time, it seemed to me that the stock market offers many people a chance to get rich quickly and easily without much physical labour or effort.

My dad --- who knew nothing about investing --- caught up with the euphoria, and he went ahead to buy a couple of stocks to get a piece of the action.

Soon after, it was the Asian Financial Crisis. The stocks that my dad bought have dropped more than 50% of his purchase prices, which are painful losses to my dad that left him confused and utterly distraught.

Since then, my father never dabbled into stocks again ... even until today.

It’s Never Too Late to Learn: How the DV Program Helped Me Invest Smarter at 70

Because of my past experience as a schoolboy, I really thought so. Stocks are risky and it is like gambling. You need to have guts and luck to make money from it.

That started to change when I hit 18.

I was doing my A-Levels in TAR College (now known as TARUMT). My classmate handed me a copy of ‘Rich Dad Poor Dad’, and it got me to be interested in the subject of finance and investing.

Since then, I became a junkie of investment books.

I read books written by Robert Kiyosaki and subsequently by other authors such as Mary Buffett, Pat Dorsey, Adam Khoo, ... etc. From them, I’d learnt that stock investing is about investing in great businesses when their prices are undervalued with the intention to hold onto them for the long-term.

Also, I learnt that what my father and his relatives were doing were not investing but in actual fact, gambling. That is very risky, a sure fire way to lose money quickly in the stock market.

So, I was encouraged to first study the business models, financials and valuations of a company before buying its shares. By doing so, I would be able to reduce losses arising from bad stocks that have poor fundamentals or from overpaying for fundamentally solid stocks at expensive prices.

Gradually, my perspective on stock investing has changed and I began to believe that true stock investing is about being conservative and by being risk-averse, I can build a stock portfolio that is not only profitable but one that is highly sustainable for the long-term.

I was interested to start shopping for stocks to invest my pocket money.

But after reading it for 30 minutes, I found myself to be completely lost.

I had no idea what I was reading and because of it, I don't know how to tell its difference between Public Bank, CIMB, and RHB, ... etc.

For this reason, I decided not to invest my money in the stock market as I have no idea what I was getting into. Instead, I signed up for an accounting course known as ACCA to learn about interpreting financial reports.

As I progress in my studies, I began to practise what I’ve learnt in class by downloading and reading annual reports of public listed companies.

I started with simpler ones such as Nestle, Dutch Lady, Panasonic, ... etc. and slowly move into complex ones such as banks, property development, construction, and oil & gas companies. I studied their business models and took notes by compiling their 10-Year financial data and stock price data onto my Excel Sheet.

I have discovered stocks with simple business models + delivered consistent growth in sales, profits and operating cash flows in the long run tend to deliver both consistent dividends + sustainable capital appreciation in the long-term.

This means: In Investing - Simple is Profitable.

As such, I have formulated a simple game plan to invest my own money. All I did is to find stocks with simple business models that are profitable, buy when they are undervalued and hold onto these shares for the long-term.

I started with a small portfolio and build on it as I continue to study, learn and gain experiences. This is done by reflecting on both my capital gains and losses. Along the way, I learnt about value traps and recalibrated my investing strategies.

In these times, dividends never fail to roll in from all my stocks into my bank or stock accounts like clockwork.

Today, I now own a 6-figure stock portfolio that is now paying me 5-figures in annual dividends. I'm collecting dividends from almost 100% of my stocks on a quarterly or semi-annual basis. I would collect dividends in 8-9 months out of 12 months every single year.

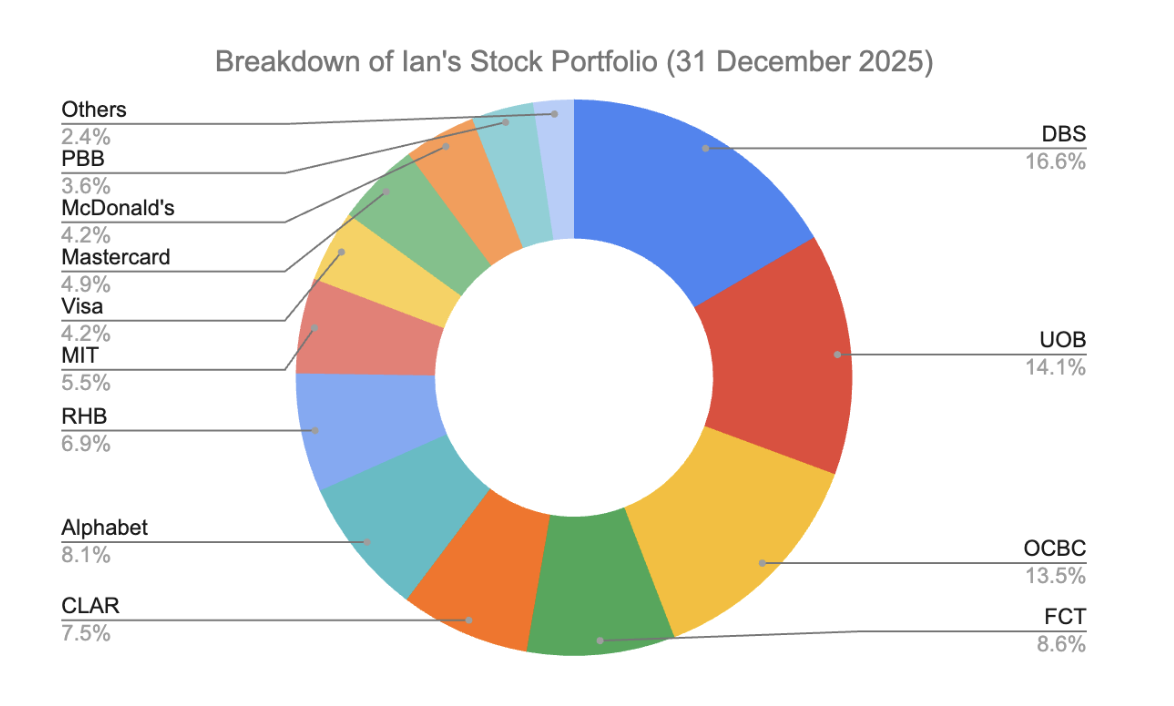

Here is a quick snapshot of my current portfolio:

After completing the Dividend Investing challenge

You wish to aim for quick capital gains, buying a stock at $1 to sell it for $2 in the shortest period. This is because firstly, I don’t know how to do that and secondly, I believe stock investing is about building wealth systematically and sustainably over the long-term.

You wish to have regular trade alerts, buy-sell calls, target prices and as well as stock tips and recommendations. This is because I believe they are not the tools necessary to help one invest profitably in the stock market. My reliance is solely on actual information sourced from a stock’s annual reports, quarterly reports, press releases, and investors’ presentations.

You wish to have sophisticated stock charting, technical analytical or trading tools. This is because I’m a full-fledged dividend investor who invests primarily in dividend-paying stocks. I aim to earn recurring dividend income over a long time and not to make profits from trading.

You wish to have us to invest your money on your behalf. Sorry, we don’t offer such services to anyone or intend to in the future. This is because our objective is to share the knowledge, experiences, and approach in stock investing so that you can replicate it yourself to build your stock portfolio independently. In other words, we believe you should be your own fund manager and take 100% of ownership and responsibility of your investment decisions.

You wish to have us compensate your losses from any direct or indirect uses of our materials. Sorry, if you made a loss in investing, you would indefinitely be bearing 100% of your losses. Why? This is because we would not be taking a single cent from you should you make an investment profit. It means you’ll be keeping 100% of your earnings and incurring 100% of your losses. Why? This is because we don’t have any control over your actions or inactions.

If you are cool with my house rules, I would now like to share how I build my stock portfolio so that you can replicate it for yourself. To do this, let me introduce to you my ideal stock portfolio.

Pay us incremental dividends consistently regardless of economic conditions, both good and bad... so that we can have increasing passive income year after year into the distant future.

Deliver an overall portfolio yield that exceeds current local Fixed Deposit rates... so that our money will never be eroded by inflation, not worrying about hikes in prices of stuff years later.

Achieve sustainable capital appreciation over the long-term... so that besides the regular income, our portfolio would grow as time pass by.

In the event of major economic downturns, prices of stocks in the portfolio must demonstrate greater resilience and rebound the fastest upon economic recoveries... so that we are less affected by the negative sentiment, and have better sleeps at night.

Most importantly, the portfolio can be passively managed without being active in stock trading and monitoring activities... so that we can always take time off to spend our well-deserved passive income and attend important family events.

Why does it work so well? ... especially for beginners in the stock market.

This is because value investing is about making investment decisions which are based on facts from credible sources which include annual and quarterly reports, press releases, and investors’ presentations.

You only invest after a careful study on the stock’s business models, management team, financial results, future plans, and valuation ratios. Usually, because of this, you only focus on the top 5% companies that have the strongest business models and financials when investing.

With them, I do not need to rely on other people’s opinions, hearsays, remarks, comments or to make guesses on where the stock market or the economy will be heading in the future to invest.

So with value investing, I can invest confidently for I can do my own study and form my conclusion on any stock before investing. It is a skill-set that allows me, my friends who are into value investing, and also millions of value investors around the globe to replicate this investment system, build profitable stock portfolios and move one step closer towards financial freedom.

This is good stuff, and it is my privilege to provide a detailed account of my investment journey with you so that you can join us to move ahead in your own financial life.

Here is a critical mindset that I would like you to adopt when investing.

You have to see yourself as a business person, not one who is just merely trying their luck or finding some sort of entertainment in Genting Casinos.

Investing in stocks is about becoming co-owners of actual businesses that have real assets and customers that generate both sales and profits repeatedly for the long-term. The process is like buying an apartment to receive incremental rental income for the long run. So you want to own the business just like how you want to own that apartment that churns out profit consistently.

Right now, I’ll be walking you through an actual case study of a stock which I’ve personally invested into so that you’ll know, on a step-by-step basis, the exact formula I use today to invest in stocks.

The stock that I invested in is DBS Group Holdings Ltd (DBS) and here are the details of my investment:

You'll have a chance to pick my brain and see what went through my mind and the thought process behind my investment in DBS at S$ 18.47 a share on 6 April 2020 which was 4 years ago.

In other words, let's turn back to 6 April 2020, which was a time before I'd clicked the button to "Buy" DBS. At that time, I had access to DBS's annual & quarterly reports as follows:

The following is a step-by-step process that I went through to access the business fundamentals & valuation of DBS on 6 April 2020.

DBS is one of the 3 largest banking groups listed in Singapore.

To assess its fundamentals, I first studied the income-generating model of DBS. Of which, I learnt that DBS earns 2 types of income, which are net interest income and non-interest income.

Let's start with net interest income.

Like any bank, savers can open savings, current, and FD accounts with DBS. It is a source of funding to DBS and DBS pays interest costs for this funding. From these funds received, DBS could disburse loans (mortgages, car loans, credit card debts, personal loans and business loans ... etc) to its borrowers to earn interest income.

The difference between its interest income and interest cost would be its net interest income.

A bank needs to grow its loan portfolio to grow its net interest income.

In DBS's case, I discovered that it grew its loan portfolio consistently from S$ 130 billion in 2009 to S$ 358 billion in 2019. This contributed to DBS's growth in net interest income from S$ 4.46 billion in 2009 to S$ 9.63 billion in 2019.

Source: DBS

Next, I looked at its non-interest income.

For DBS, most of its non-interest income is driven by fees and commission income earned from:

Of which, driven by growth in fees & commission income, DBS's non-interest income had grown from S$ 2.15 billion in 2009 to S$ 4.92 billion in 2019.

Source: DBS

Combined, DBS's total income (net interest income + non-interest income) had increased from S$ 6.60 billion in 2009 to S$ 14.54 billion in 2019.

Source: DBS

Next, I wanted to know if DBS is good at controlling costs. Here, there are 2 types of costs to look at: Operating Costs & Impairment Loss.

Let's start with operating costs.

Like most banks, DBS incurs employee costs, technology-related costs, rent, administration, utilities and marketing costs. These are all categorised as "operating costs". The method to find out if DBS is able to control costs effectively is to assess its "cost-to-income ratio".

Based on its past annual reports, I learnt that DBS had maintained its cost-to-income ratio at 40%-45% for the long-term. It means DBS's rise in operating costs were kept in line with its growth in total income over the 10-year period (2009-2019).

Source: DBS

Next, let's look at impairment loss.

Sure, as an investor, I want a bank to achieve growth in loan portfolio so that it could earn more net interest income. But, at the same time, I want a bank to also be conservative in lending, which is to lend only to quality borrowers who would repay or service their loans promptly on-time.

I don't want huge loan defaults.

The way to measure the level of a bank's loan defaults is to assess its non-performing loan (NPL) ratio. A high NPL ratio indicates that a bank has higher loan defaults. Hence, a low NPL ratio would be preferred by investors.

For DBS, its NPL Ratio was kept low at 1.5% in 2019.

Source: DBS

I found DBS's NPL Ratio in 2019 to be attractive because it was similar to the other two Singapore banks: UOB and OCBC and it was a lot lower as compared to most Malaysian banks (except Public Bank and Hong Leong Bank).

So in terms of cost control, DBS has maintained a stable and low cost-to-income ratio and NPL ratio for the 10-year period (2009-2019).

At this point, I knew that DBS had increased its total income while having good cost control and low non-performing loan (NPL) ratio. Combined, it is a recipe for growing earnings and dividends.

I found that DBS had increased its earnings from S$ 2.03 billion in 2009 to S$ 6.30 billion in 2019. It had paid out rising amount of dividends, where the amount of dividends per share (DPS) had increased from 56 cents to S$ 1.23 in that 10-year period (2009-2019).

Source: DBS

Source: DBS

Now, a quick reminder - I was looking to invest in DBS on 6 April 2020, which was during the lockdown period due to COVID-19. It was a time of great uncertainty with stock markets worldwide crashed swiftly and no one knew exactly when we would come out of this pandemic.

In a time like this, I focused on DBS's balance sheet strength as I need a bank to be financially resilient to survive through COVID-19. To do this, I studied 3 ratios: Total Capital Ratio (TCR), Liquidity Coverage Ratio and Loan Allowance Coverage (LAC).

1. Total Capital Ratio

TCR tells us how well a bank could meet its obligations. Does it possess enough capital to absorb losses before becoming insolvent? Here, what I knew is that the Monetary Authority of Singapore (MAS) had imposed a minimum TCR of 12.5% for all banks in Singapore.

For DBS, its TCR was kept well above 12.5% at all times in 2009-2019. Hence, I knew that DBS at that time was well-capitalised and was able to absorb losses and survive during COVID-19.

Source: DBS

2. Liquidity Coverage Ratio (LCR)

LCR tells us if a bank has enough capital to meet short-term liquidity needs. For Singapore banks, the minimum LCR required is set to be at 100%. In the case for DBS, its LCR was kept well above 100% in 2015-2019. So, I knew the bank has ample liquidity to not only meet short-term needs but also to fund growth initiatives in the future.

Source: DBS

3. Loan Allowance Coverage (LAC)

LAC tells us if a bank has set aside sufficient allowances to cover for its loan losses. A bank that is more conservative would put more reserves to cover for its loan losses and thus, would have higher LAC.

in 2019, DBS's LAC was 94%. It is higher than most banks listed in both Malaysia and Singapore except for Public Bank and Hong Leong Bank at that point in time. This means, when it comes to being conservative, DBS ranks among the top half in Malaysia and Singapore.

Source: DBS

Based on these 3 ratios, I concluded that DBS is financially resilient as its balance sheet is strong. This is further accentuated with "AA-" and "Aa1" credit ratings, which was among the highest in the world.

So, up till 2019, I learnt that DBS in 2019 was rock solid fundamentally as it has generated consistent growth in profits while keeping a strong balance sheet over the long-term.

When it comes to investing, that is already half the battle won.

However, a fundamentally good stock is only a good investment if its shares are undervalued or fairly valued. Thus, the final step I took was:

On 6 April 2020, DBS's stock price had already tumbled by 25%-30% from S$ 25-26 to S$ 18.47 a share. So, does it automatically indicate that DBS was undervalued?

Not quite.

A fall in stock price doesn't necessarily indicate that it has "already" become undervalued. As an investor, what I did was to go through the first 4 steps above to make sure that the stock is fundamentally solid first & if it is so, like the case for DBS, I would value its stock.

This is done by calculating its current P/E Ratio & Dividend Yields.

Then, I would compare its current P/E Ratio & dividend yield with its past historical P/E Ratio & dividend yield for the last 10 years.

1. Current P/E Ratio & Dividend Yield

In 2019, DBS made S$ 2.46 in earnings per share (EPS) and paid as much as S$ 1.23 in dividends per share (DPS). Based on S$ 18.47 a share, which was the current stock price on 6 April 2020, its current valuation would be:

Current P/E Ratio (6 April 2020):

= Stock Price / EPS 2019

= S$ 18.47 / S$ 2.46

= 7.51

Current Dividend Yield (6 April 2020):

= (DBS 2019 / Stock Price) x 100%

= (S$ 1.23 / S$ 18.47) x 100%

= 6.7%

2. Past 10-Year Historical P/E Ratio & Dividend Yield

Next, I would calculate DBS's P/E Ratio and dividend yields over the last 10 years. This is first done by compiling DBS's:

Of which, I produced a table as follows:

Source: DBS

Starting with P/E Ratio, DBS's P/E Ratio ranged between 8.9 to 14.7. Its 10-year average was 11.2. If DBS's stock price is valued at P/E Ratio below 11.2, it means that its shares are undervalued. That is the case for DBS as its current P/E Ratio at that point in time was 7.5 (below 11.2).

It is the same concept with dividend yields.

DBS's dividend yield in 2010-2019 ranged between 2.8% to 5.1%. Its 10-year average was 3.9%. As an investor, I would buy DBS if its dividend yield is above 3.9% as it is an indication of its shares being "undervalued".

Based on its current dividend yield of 6.7% per annum, DBS was indeed undervalued as its dividend yield at that time was above its 10-year average of 3.9%.

As such, I found DBS to be undervalued after I've calculated its current P/E Ratio and dividend yield and compared them to its past historical average.

On 6 April 2020, I decided to invest in DBS at S$ 18.47 per share (despite uncertainties due to COVID-19) as I found it to possess the following qualities:

Understandably, DBS recorded a decline in earnings to S$ 4.61 billion in 2020. This is caused by significantly high impairment loss as its borrowers were impacted by COVID-19.

On 29 July 2020, the Monetary Authority of Singapore (MAS) called all local banks in Singapore to limit their dividend payouts at 60% of what they have paid in 2019. For this reason, I have earned less dividends for 4 quarters (Q2 2020-Q1 2021).

Personally, I understood and applauded this decision to cut dividends on a temporary basis. I viewed this to be a strategic move to further strengthen the bank's capital position in order to ride through COVID-19.

As this is initiated by the MAS, such dividend cuts are not reflective on DBS's underlying fundamental ability to earn income and pay dividends. As such, I continued to hold on.

Beginning in 2021, DBS's earnings had recovered to 2019 level as the pandemic situation has improved. From then, with higher total income and impairment loss normalising, DBS had delivered continuous growth in earnings in 2022-2024.

Source: DBS

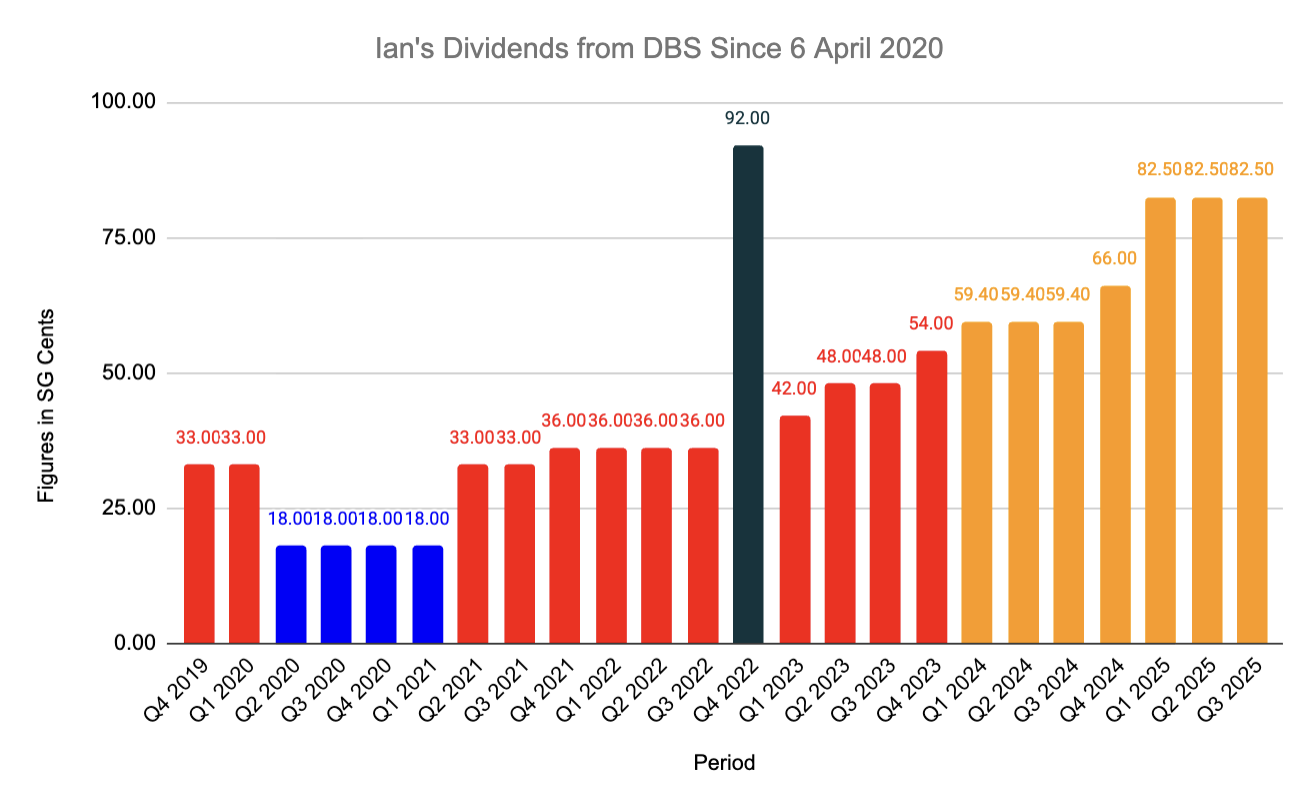

As DBS is consistently profitable, I continue to receive dividends regularly on a quarterly basis. Below are the gross amount of dividends I have been receiving since 6 April 2020:

Source: DBS

Notes:

- The "Blue Bars" refer to dividends paid to me in Q2 2020-Q1 2021 when the MAS placed a cap of 60% dividend payouts from 2019 levels.

- The "Green Bar" is inclusive of a one-off special dividends of 50 cents.

- The "Yellow Bar" refers to periods after I have received 1 bonus share for every 10 shares held. DPS in these periods had been adjusted to reflect this bonus issue.

In total, I received S$ 11.237 in dividends per share (DPS) over the last 6 years. So, my gross cash returns from DBS is 60.8%.

But, what about capital appreciation?

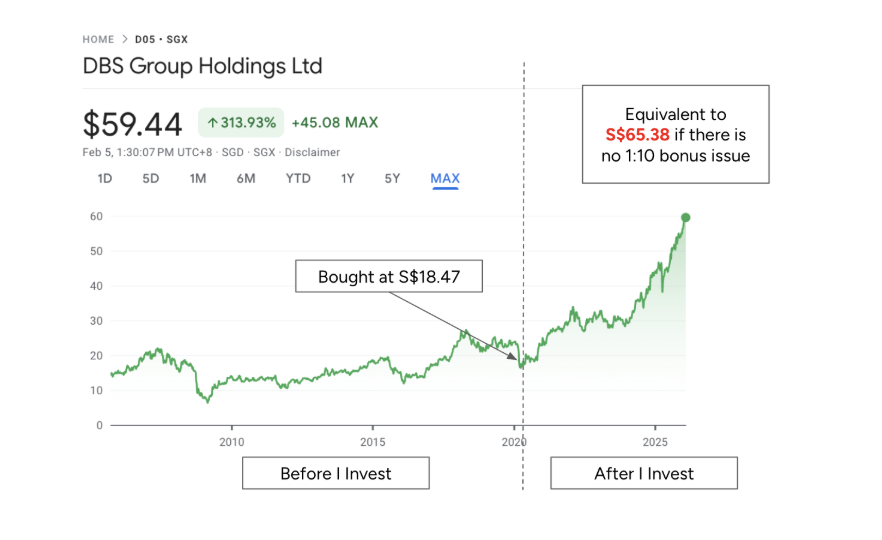

Source: Google Finance

As I write, DBS is trading at S$ 59.44 (equivalent to S$65.38 if there is no bonus issue). The growth in stock price was a reflection of its growth in earnings over the last 5 years. Based on my investment price of S$ 18.47 a share, my gross capital appreciation to-date is 254.0%.

Hence, my total gross returns from DBS works out to be 314.8% in 6 years.

(60.8% + 254.0% = 314.8%).

Can you see that you too can build a stock portfolio that brings you a steady and increasing flow of dividend income year after year without you trying to predict stock prices?

You have just witnessed how I personally used the 5-step process above to first, identify high-quality dividend-paying stocks from the others which couldn’t. And second, do a proper valuation of these stocks so that I can invest in them when their prices are cheap or undervalued.

Mastering the 5-step process above allows you to invest confidently as you will:

Well, the above 5-step process is my blueprint towards building a money-making stock portfolio that is replicable in any stock market around the world.

And, it is now yours.

You can take it and replicate my successes in stock investing.

You can now go to the website of your preferred stocks, download the latest 10 years of annual reports, quarterly reports, investors’ presentations and press or media releases of these stocks, study them, compile their key information such as their financial data and operating figures, and calculate their valuation ratios over the last 10 years. All of this information is free and readily accessible to all investors, including you and me. So now, you can start right away ...

‘Ian, wait …

Sure, you can open a stock brokerage account and start buying shares. Nobody is stopping you from doing so.

My question to you is, ‘How do you separate good stocks that make you money from bad stocks that cost you money ... without reading financial reports? How will you know whether or not if a stock is undervalued or overpriced if you do not calculate its valuation ratios?’

As you can see, one thing is for sure.

If you have a sincere desire to make money from investing in stocks, you cannot skip this process. Investing is a skill set, and it takes time to master. I studied and read annual reports on a daily basis for the last past decade of my life. Personally, I started with a small portfolio and grew it gradually as I continued to sharpen on my investing skills and experiences over time.

The same applies to many things in life.

If you wish to become a medical doctor, you have got to spend years in medical school and complete your housemanship before qualifying as a medical doctor. The amount of time taken will be much longer if you wish to be a specialist or a surgeon.

The bottom line is ... You have to first learn how to invest and put in the effort to do your due diligence before investing your money.

You can’t skip this process if you want to be consistently profitable. Period.

But hours daily on learning, studying, reading, calculating, and evaluating stock deals for years is a long time, and I do not know exactly what your present level of confidence is when it comes to stock investing:

Is it 20%? 30%? or 50%?

Well, what if I can walk through with you on the strategy to build a kickass stock portfolio that pays increasing dividends year-after-year on a step-by-step basis? Would it increase your confidence level to the 80% or 90% range?

And, what if you have access to my ongoing compilation works and case studies on these dividend-paying stocks so that you can shorten your learning curve to just 2-3 months from 2-3 years?

Well, if you are interested, I’m going to give a few of you that opportunity.

After completing the Dividend Investing challenge

I’m going to walk some students through this master class.

This programme is called ‘Dividend Vault’, and as one of my students, we would be creating a stock portfolio that pays increasing dividends year-after-year from start to finish together.

So if you want to ‘Copy & Paste’ an investment strategy that is proven to work, get it right from your first or next stock investment and move one step closer towards financial independence, then, this programme is for you.

It is an implementation programme, when by the time we are done, you would have a complete strategy to build and design a stock portfolio which pays you incremental dividend income, either on a quarterly or semi-annual basis, and the money comes in like clockwork.

So, here is the breakdown of what exactly we are going to do together:

The Roadmap to a 6-Figure Dividend-Growth Portfolio

5 Viewpoints on Risks

2 Systems Needed to Build & Sustain Your Dividend-Growth Portfolio

5 Criteria of Strong Business Models

How to Assess Stocks' Financials Like a Pro?

Finding Growth Initiatives of a Stock

The Art of Stock Valuation

Portfolio Management: Dealing with Falling Stock Prices

Portfolio Management: Dealing with Rising Stock Prices

Expand, Diversify and Protect Your Portfolio

After completing the Dividend Investing challenge

Can Case Studies Replace Hard Work in Dividend Mastery?

By then, you would have been transformed into a savvy investor who knows how to build and manage a dividend-producing portfolio independently.

But, although you know what and how you need to do to build such a portfolio, you may ask:

‘Will it take me hours of my time and effort to sit down and study these stocks from scratch every day?’

‘Man, it’s too hard, and I don’t have the time and energy to spend time on it.’

I get it and here is the thing: ‘What if I give immediate full access to my case studies and templates on 50+ high-quality dividend-paying stocks listed on Bursa Malaysia and the SGX?’

Can Case Studies Replace Hard Work in Dividend Mastery?

You can save an enormous amount of time by leveraging on my ongoing compilation work of vital financial data and my write-ups on the stocks through these handcrafted case studies.

‘Okay Ian, what is in your template and case studies?’

10-Year Profitability and Balance Sheet Data

10-Year Cash Flow Management Data

10-Year Operating & Segment Data

5-Year Quarterly Results

10-Year Stock Valuation Data

"Dividend Vault is a good online course that taught some of the important parameters to look for when evaluating stocks."

Now, let’s talk about my case studies. They are hand-crafted materials to guide you step-by-step on how I would assess a stock deal from scratch.

Every case study contains two parts:

It consists of my findings of the stock’s business model, its annual and latest 12-month financial performance, its balance sheet strength, and more importantly, its initiatives to grow in the future. This would allow you to effectively identify great stocks with great fundamentals from bad ones which don’t, reducing your chances of incurring losses from bad stocks.

It consists of calculations of its P/E Ratio, P/B Ratio, and Dividend Yields for each stock and a comparison on them against its long-term past valuation ratios. Thus, it enables you to know how to easily value a company so that you can refer to it and use the same technique to assess the value of your next stock investment.

In essence, we give you a highly customised set of materials such as video tutorials, presentation slides, eBooks, and as well as templates and case studies of 50+ high-quality dividend-paying stocks. All these could help you kickstart your journey to build a stock portfolio that pays dividends that are consistently increasing year-after-year so that you’ll move one steps towards financial freedom.

I have shown you that it is absolutely possible for you to start building a stock portfolio which pays you recurring and growing dividends systematically year after year without relying on tips, rumours, hearsays, brokers’ reports, and highly sophisticated charting software.

And you knew that this is possible if you possess the right mindset, right sets of skills, and a specific game plan to build wealth sustainably from investing in the stock market. Better still, you can replicate this investment model in Singapore.

And the best part is that you can start by ‘Copy & Paste’ my personal game plan in stock investing and start reaping increasing dividends for yourself.

So, if you are ready to acquire the mindset, skills, and a game plan to start your journey towards your first or next dividend income, here is how you can sign up for the membership. The classes, templates and the case studies of as much as 50+ best dividend-paying stocks in MY and SG are already made available in the Private Member’s Area so you can get started immediately.

By the time you’ve completed the Modules, you would be able to fully leverage on my templates and case studies to select your preferred dividend stocks, invest and build a portfolio that pays you growing dividends regularly.

"The Dividend Vault has made it easier for me to pick stocks because it consists only of stocks that are fundamentally strong. Hence, I only needed to pick my stocks from this smaller pool of stocks. "

The retail price for the Dividend Vault Membership is RM 999 / year.

If that sounds expensive, keep this in mind ...

Today, it costs you between RM 5,000-RM 10,000 to attend a 3-4 day workshop on either stock investing or trading and even after days of intense training, you most likely still get stuck to do stock research on your own.

Dividend Vault is designed to be a long-term companion to guide you on a step-by-step basis to build your dividend portfolio at a fraction of typical workshop fees. Once you get the hang of it, you own this highly invaluable skill set for life.

But the fact that you are still with me on this page shows that you have a desire and are serious about attaining investment success for yourself. So, here’s what I’m going to do...

I like to see you succeed and hence, will be thrilled to know that you have gone through my work and have used them to improve your financial life.

So, if you are willing to invest in yourself today, I’m eager to invest in you.

To put that into perspective, you have just seen how I had built a stock portfolio that pays increasing and recurring dividends from scratch in the above example. So, would you invest a few hundred ringgits in replicating that investment model? I sincerely hope so.

I want to make this a completely safe and risk-free decision for you.

So, I’m going to give you an unprecedented 3-part guarantee that is unheard of.

First, I'm going to give you a no-questions-asked 30-day money-back guarantee.

If you join this round at whatever price it is, you locked in subscription fee for life. It means you will always be paying the same subscription fees. NO INCREMENT ever. Regardless of how the situation is in the future, we won't raise your subscription fee for any reason.

The third one is where things get really interesting... Believe it or not, I’m not here to sell you yet another membership program, and I’m going to prove that to you right now...

Here is how you can complete the Dividend Investing Challenge

First, watch and follow along the Tutorial Videos made available in the Modules within the membership. They would equip you with the wisdom to comprehend my ongoing updates on the 50+ dividend stocks contained within Dividend Vault.

Second, browse through the 50+ dividend stocks and invest in 5 different stocks which fulfil the following criteria:

Third, keep a copy of the statements of your stock investment account and also your dividend vouchers or statements. After you received your first payment of dividends from each of your 5 stocks, please email me a copy to prove that you had received the dividends. My email is [email protected].

You can do it anytime for the next 12 months after your subscription to Dividend Vault. When you do, I'll send you an extra RM500 as your bonus dividend. I'll deposit the money to your bank account.

"The Dividend Vault is really an excellent program!

Since adopted the concepts of Dividend Vault, I have never lose money and my wealth compounded."

"Being a newbie in stock market, and also having lost some money previously when I invested on my own, the Dividend Vault is a good place for newbies to start a portfolio"

"Dividend Vault had assisted me greatly as it saved me time and effort to find fundamentally strong stocks to invest. Moreover, it helped me to evaluate whether a stock price is fair, undervalued or overvalued."

"Dividend Vault is a great online course and the modules are well designed and delivered."

A very good source of summary of key areas to assess before making any investment. Would suggest to give some broad information, for e.g. the basis of selec...

Read MoreA very good source of summary of key areas to assess before making any investment. Would suggest to give some broad information, for e.g. the basis of selecting only specific companies for inclusion in the Dividend Vault compared to the whole population (in Bursa Malaysia, and SGX), and the basis and timing of periodic update. Thanks for the good work.

Read Lessi have learnt how to pick a dividend paying stock based on its revenues,net profit and net cashflow from operations based on its 5 or 10 yrs record from its ...

Read Morei have learnt how to pick a dividend paying stock based on its revenues,net profit and net cashflow from operations based on its 5 or 10 yrs record from its annual n quarterly reports and how to value it based on its 5/10 yr highest,lowest and average P/E ,P/B ,DY.I also learnt ,I have to look at its business model,whether it is sustainable or not ,with emphasis on cash generating businesses.and the most important is to invest in a stock when it is undervalued.

Read LessAppreciate the effort taken to compile and fit together towards having an overall comprehensive training module. It is noteworthy and testament to Ian's cred...

Read MoreAppreciate the effort taken to compile and fit together towards having an overall comprehensive training module. It is noteworthy and testament to Ian's credibility mashed together with KC's experience as sifu to the overall process of building an investment portfolio that can withstand inflation and hopefully leave behind a legacy of compounded interest in inheritance fortune.

Read LessA very good and profound intro. Hitting the right spot to clarify about equity investing. A new pathway is opened👍👍👍 Next to acquire the skills🙏

A very good and profound intro. Hitting the right spot to clarify about equity investing. A new pathway is opened👍👍👍 Next to acquire the skills🙏

Read LessIn other words, I’m going to pay you to finish the Modules, begin investing, and change your financial life.

I’ve never seen anyone else who is willing to do this, so why am I?

This is because I want to reward people who take action and achieve success. It allows me to achieve my ultimate goal of turning you and many more friends to become successful in stock investing quicker and more efficiently, which is from my point of view, a lot more meaningful than just earning money itself.

As such, there’s literally no way you can lose here. At a bare minimum, you have a 30-day money-back guarantee to view what’s in Dividend Vault risk-free. And when you have invested into 5 stocks and collected dividends from them, I’m going to send you extra RM500 as a bonus dividend to your bank account.

So, here’s what you should do to get started. Click the button below right now to join: Ready to JOIN.

A fully secured checkout page will pop-up in a new window so fill it up and click submit. After making your payment, you'll access the members area instantly. And that’s it.

Watch the welcome video to get started, follow along the 10 Modules, and you can build a dividend portfolio by referring to my templates and case studies on 50+ best dividend stocks listed in Malaysia and Singapore.

So, at this point, let me recap the offer: You’ll be officially enrolled into Dividend Vault, a membership program that not only guides you but rewards you to learn and build a stock portfolio that would churn recurring and increasing dividend income into your bank account.

You’ll get a 30-day 100% money-back guarantee so that you can check it out for yourself risk-free. More importantly, you’ll be able to take up my Dividend Investing Challenge. Follow the Modules, Invest in 5 stocks, Collect Dividends from them, and please submit these statements to me within the next 12 months and I’ll pay you extra RM500 BONUS DIVIDEND via bank-in transfer.

Thus, I would like to invite you to get onboard the Dividend Vault. So click the button below to get started, and I’ll see you in the Private Member’s Area.

KCLau & Ian Tai

KCLau & Ian Tai

Here are all the things you will be getting

10 Modules of Dividend Vault Stock Training

Instant Access to 50+ High-Quality Dividend-Paying Stocks

Bonus: Full Access to Written Case Studies Updated Regularly

GUARANTEE #1: 30-Days Money Back, No Question Asked

GUARANTEE #2: No Increment on your Subscription Fee ever

GUARANTEE #3: RM500 Bonus Dividend payment if you Complete the Dividend Investing Challenge within the 1st Year

You can cancel anytime

Here Are Your Questions Answered

Nope. These are all exclusive training prepared by Ian Tai just for Dividend Vault members only.

The significant value of DV is the constant updates of the 50+ top dividend-paying high-quality stocks and case studies. Ian updates that whenever there are new financial results announced by the companies. He keeps track of those excellent companies that deliver consistent growth in revenues and profits, so that you can start building your own portfolio to enjoy good dividend yields for many years to come.

If you pay through a credit card or debit card, you will be on autopay on the same day the next year. But if you pay through bank transfer, there is no auto-renewal, and you will need to remit payment on the subsequent renewal next year.

You can cancel anytime you like. Within the first 30 days, you will get back the full amount.

After the 30-day money-back period, you can also cancel anytime. And you will still have access to the members' area until your the next renewal date.

Just send a simple email to [email protected], informing your intention to cancel. You don’t need to call us, nor Whatsapp. We will reply with the confirmation. If you don’t hear back from us within 24 hours, please contact us at https://kclau.com/support.

Alternatively, you can also navigate to the billing page inside the members’ area.

1. Login at https://courses.kclau.com

2. Click on your name or picture in the top-right site header.

3. Select “My Account”

4. Select the “Billing” tab.

5. You can update your credit card info or cancel the subscription there.

6. You will automatically lose access to the content at the end of your billing period.

"The course content has helped guide me on the general process of understanding and determining which stocks are worth obtaining as well as formulating a game plan."

"Dividend Vault course has helped me to build a dividend portfolio through the step by step case studies and the top 50 stocks list albeit a small one."