GROWTH VAULT

Stop Chasing Tips. Start Owning the World’s Best Businesses.

A practical, proven way to build wealth by investing in the top 1% of global companies.

A clear, step-by-step system—no hype, no guesswork: I'll guide you through the step-by-step process of constructing a growth-oriented portfolio brimming with global powerhouses—businesses so scalable and expandable, they're practically begging to make you money.

Build a resilient, growth-focused portfolio: Imagine navigating any market condition—bull, bear, or sideways—like a pro. I'll elevate your investment skills so you're not just a casual player, but a savvy Growth Investor capable of independently managing your portfolio through thick and thin.

Exclusive access to 25+ case studies of industry leaders: No more shooting in the dark. I'll throw open the doors to my Growth Vault, packed with 25+ meticulous case studies focusing on the cream of the crop—companies listed on the NYSE and NASDAQ that make up the top 1% of global businesses.

It’s designed for investors who want to:

Grow your wealth in USD and hedge against Ringgit depreciation

Own world-class companies driving global growth

Build a resilient, diversified portfolio you can trust long term

Avoid guesswork, hype, and endless chart-watching

Follow a clear, proven process—no complicated tools required

A Personal Note from Ian Tai

Before we go further, I want to be completely transparent with you:

This page is written by me—Ian Tai.

It’s not some generic corporate sales pitch.

I’m sharing this with you because I personally co-developed Growth Vault with my boss and mentor, KCLau, and I want you to know exactly why we built this program.

If you’re reading this, you might be wondering:

“Who is Ian? Why should I trust Growth Vault to help Malaysian investors like me?”

Here’s my answer.

When I first started investing seriously, I struggled with the same things many Malaysians do:

✅ Too much noise and tips, but no clear strategy

✅ Wasting time researching but lacking confidence

✅ Fear of making expensive mistakes

Over the years, working with KC, I saw firsthand how his approach cuts through the noise.

He doesn’t just tell you what stocks to buy, but teaches you how to think, how to evaluate, how to hold with conviction.

We created Growth Vault together with a very clear purpose:

✅ To save you years of trial and error

✅ To give you a quick start with a structured, proven framework

✅ To help you achieve small early wins that build your confidence

✅ And ultimately, to guide you toward true investment mastery over time

I wish I had this kind of step-by-step system when I started.

It would have saved me so much time, money, and stress.

That’s why I’m sharing this with you now.

So you can avoid the common mistakes and start building your wealth with clarity, confidence, and discipline.

I hope my story helps you decide whether Growth Vault is the right next step for you.

Then, listen up! I'm about to lift the curtain on the game-changing strategies I've mastered for building a powerhouse Growth Portfolio—and guess what? You won't need a PhD in chartology or be a wizard with technical tools to get it right. It's all about smart, straightforward tactics that really work. 📊🚀

I wish I could tell you I was born a natural investor. But the truth is, I wasn’t.

I didn’t grow up with a finance background. I come from a working-class family. I wasn’t trained or groomed to be an investor.

But I realised something important: I needed to learn. And the smartest way wasn’t to reinvent the wheel, but to study those who already succeeded.

That’s what I did. I read, listened, and learned from the best—especially Warren Buffett.

Buffett’s principles are simple, logical, and incredibly useful even in today’s volatile markets. He taught me you don’t need to be a genius—you just need to copy sound principles and apply them with discipline.

Investors who follow these time-tested ideas have built real, lasting wealth. Those who try to figure it out alone often pay the price in losses, stress, and wasted years.

That’s why I built Growth Vault: to share the same principles and proven methods that changed my own investing. So you don’t have to start from scratch or risk expensive mistakes trying to “figure it out” on your own.

The difference in mindset between Buffett and most investors is like day and night—and it often explains who wins and who loses.

To name a few, they are as follows:

Because too many investors lose money chasing tips and rumours instead of following a clear, proven strategy.

Many investors never build a meaningful portfolio that grows steadily and pays reliable dividends.

They buy and sell on tips, rumours, recommendations, target prices, and emotion.

This is the #1 reason they lose thousands, even millions, in hard-earned capital.

But it doesn’t have to be this way.

When you know how to build, manage, and grow your portfolio with a clear system, you can:

✅ Avoid costly mistakes that derail most investors

✅ Protect your wealth in all market conditions

✅ Increase your chances of real capital appreciation and consistent dividend income

That’s exactly what I’ll help you do in Growth Vault.

Value investing is about buying GREAT BUSINESSES at attractive prices and holding them long-term as they grow in value.

It works because it relies on FACTS, not hype.

Value investors make decisions based on solid evidence—like annual reports, financial statements, and clear business strategies.

Instead of chasing tips, rumours, or price predictions, they focus on truly understanding the companies they own.

Here’s how it works in practice:

✅ Study the company’s business model

✅ Evaluate management quality and growth plans

✅ Assess its true valuation—not just today's price chart

When you do this, you don’t need stock tips or fancy chart patterns to tell you what to do.

You can make YOUR OWN informed decisions.

And that’s the real FREEDOM investing can offer you.

There are 2 main types of Value Investing: Dividend Investing and Growth Investing.

I started as a Dividend Investor (and I still am today) because dividend investing is EASIER and PERFECT for beginners who want to build a reliable stream of passive income.

In my early years, my portfolio was small. I earned small dividend payments and had minor capital gains or losses.

These early experiences were pivotal and educational.

Through them, I discovered something important:

The most efficient way to enjoy GOOD DIVIDEND YIELDS, CAPITAL GAINS, and diversify wealth away from MYR risk is to invest in the TOP 1% companies in Singapore.

Over the years, I built a portfolio focused on top-tier Singaporean companies.

Today, I earn regular dividends for 8–9 months EVERY SINGLE YEAR—no matter what the stock market or economy is doing.

I co-founded DividendVault.com as an educational platform with KCLau, my partner and together, we have empowered our subscribers from diverse backgrounds to build solid portfolios that generate dividends year-after-year.

The Ringgit has consistently lost value against the Singapore Dollar.

Over the last 5 years, the MYR has depreciated at a CAGR of ~2.0% against the SGD.

What does this mean for Malaysian investors?

If you’re earning 4%–5% annual dividend yields in MYR, you’re essentially “not earning much” after factoring in the 2% annual currency depreciation against SGD.

Think about it:

✅ Your dividend yield is real, but the buying power can erode.

✅ Currency depreciation quietly eats away at returns.

✅ Even “good” yields in MYR may lag behind if the Ringgit keeps weakening.

Personally, I chose to diversify into SGD-denominated assets.

My dividend receipts are predominantly in SGD, and I realised:

A 4%–5% annual yield in SGD is VERY different from a 4%–5% yield in MYR.

It’s not just about the yield percentage—it's about protecting and growing your real wealth over time.

That’s why diversification beyond MYR isn’t just smart.

It’s necessary.

To be clear, I have tremendous respect for the Singapore stock market.

It’s become one of Asia’s top financial hubs.

✅ Political stability

✅ Excellent corporate governance

✅ Favourable tax structure for dividend investors

I invested there for years because it offered solid, reliable opportunities.

But here’s the truth: Singapore is a small nation of just 5+ million people.

No matter how well-run it is, it has natural limitations:

Limited talent pool

Smaller market size

Fewer industries and sectors

Eventually, I realised:

If I stuck only to Singapore, I’d end up holding “most” of the good companies there.

That’s concentration risk—just in another form.

I wanted more diversification.

More global brands.

More industries.

More geographies.

If I wanted to own the best businesses in the world, I needed to look in a bigger, deeper market.

That’s why I turned to the U.S. stock market.

One of the reasons I trust KCLau as my mentor is simple:

He doesn’t just talk about investing—he actually does it.

Over the years, KCLau has built a substantial U.S. stock portfolio filled with some of the world’s top 1% companies:

Apple, Alphabet, Amazon, Costco, Meta, Berkshire Hathaway, just to name a few.

These are world-class businesses most of us have heard of.

So the question isn’t really “What stocks did KC buy?”

The real question is:

How did he choose them?

How did he know when they were worth buying?

How does he manage them through the ups and downs?

That’s what sets successful investors apart.

Not memorising a stock list, but understanding:

What do you really know about these businesses before investing?

How do you value them rationally?

What is your plan for holding and managing them long term?

How will you react when prices drop or markets get volatile?

These are the exact questions KC taught me to ask.

Inside Growth Vault, that’s what he shares with everyone who wants to invest smarter.

Not just stock picks—but the thinking, the process, and the discipline behind them.

The above is KCLau's portfolio since Dec 2018.

To illustrate, I’ll be walking you through KCLau’s actual investments into Berkshire Hathaway.

This is done on a step-by-step basis so that you get to pick our brains and assess our mentality and approach when it comes to stock investing.

So without further ado, let’s begin.

KCLau initially stumbled upon Berkshire Hathaway in the year 2000. He candidly admits that he wasn't savvy enough back then to grasp the power of long-term stock investment as a superior wealth-building strategy.

It wasn't until 2012 that KCLau dived deeper into understanding Berkshire Hathaway. During this period, he became well-acquainted with the tenets of value investing, which, unsurprisingly, emphasized buying shares in solid companies and holding them for the long haul.

As part of his homework, KCLau closely studied how Berkshire Hathaway leveraged its insurance ventures to construct a diversified conglomerate and amass a stock portfolio valued in the billions. 📚💰

From his studies, KCLau discovered that, from 2000 to 2012, Berkshire Hathaway had reported the following:

Due to its fundamental strength, KCLau bought his first shares of Berkshire Hathaway at US$ 120-130 per share in 2013.

Subsequently, KCLau made a few more investments into Berkshire Hathaway Inc around US$ 150-170 per share in 2016-2017 as the stock’s businesses continued to improve.

Then in August 2018, KCLau sold off all of his shares in Berkshire Hathaway for around US$ 200 a share each and used the proceeds as down payment to buy his residential property for US$ 555k in the U.S.

Today, as KCLau had moved to Taipei, the home is tenanted for US$ 3000 a month and its price had appreciated to US$ 760,000 presently.

KCLau's house in the USA

KCLau's house in the USA

After KCLau sold off Berkshire Hathaway in 2018, he continued to keep himself updated on its business results as he planned to invest his money back into the company.

He bought some Berkshire Hathaway in 2019 but the true opportunity came in 2020-2021 during Covid-19.

At that time, Berkshire Hathaway fell below US$ 200 to US$ 170-180 levels, which was even lower than price he sold his shares in 2018.

But in terms of its fundamental strength, Berkshire Hathaway in 2020 was more “solid” as compared to itself back in 2012 when KC Lau first bought it.

This is because since 2012, Berkshire Hathaway had continued to:

So in 2020-2021, KCLau found that Berkshire Hathaway was not only fundamentally “more solid than before” but also was undervalued at US$ 170-180 levels.

Thus, armed with such knowledge, KCLau invested into Berkshire Hathaway confidently. When everybody are so fearful of the future due to Covid-19 lockdown, he just went in to buy more shares happily.

As a result, KCLau is now 2-3X up in capital appreciation for his shares in Berkshire Hathaway, which he bought 2-3 years ago.

So, the chronology of transactions KC made in his investments into Berkshire Hathaway can be summarised as follows:

Source: Google Finance

is that he wished that he know or learn about value investing much earlier in life.

KCLau first bought Berkshire Hathaway when he was in his early 30s. Before that, he tried stock trading and lost money in his early 20s.

Then in his late 20s, he just parked his money in unit trust as he thought it to be less risky as compared to stocks.

Just imagine that he knew about value investing in his early 20s, when he could invest in Berkshire Hathaway for US$ 50 a share.

His capital appreciation wouldn’t be just 2-3X in 2-3 years, but 6-7x in a span of 25 years.

What If Building This Kind of Portfolio Was Simpler Than You Think?

Imagine owning a U.S. stock portfolio filled with the world’s top 1% companies, growing in value year after year.

You just saw how KCLau did it:

Focusing on the business fundamentals of every stock he buys.

Valuing them carefully to avoid overpaying.

Holding them long term—ideally forever, to let compounding work its magic.

If you master this approach, here’s what you gain:

Greater confidence knowing you’re buying strong businesses with real staying power.

Improved chances of sustainable capital appreciation, in line with these companies’ long-term growth.

Reduced investment risk, because you’re avoiding overpriced or fundamentally weak stocks.

Peace of mind knowing you have a clear, proven strategy—not just reacting to market noise.

This is exactly what you’ll learn inside Growth Vault.

Not just what to buy, but how to think, evaluate, and hold for lasting wealth.

As I’ve said before, what KC and I do isn’t some secret formula.

It’s actually simple, proven, and timeless.

Millions of successful investors around the world have used these value investing principles to achieve consistent dividends and steady capital gains in their portfolios.

These principles are learnable, repeatable, and practical.

If you’re ready to start building your own portfolio the right way, here’s what you can begin doing right now:

Download and read the annual and quarterly reports of companies you’re interested in.

Compile their key operating and financial data.

Calculate valuation ratios to see if you’re getting a fair price.

Build a watch list of companies worth owning—and get ready to act when the price is right.

All of this information is free and accessible to any investor willing to put in the time.

If you’re willing to learn, you can do this on your own.

But if you want to shortcut the trial and error, save time, and learn a structured approach that’s worked for us, that’s exactly what we teach inside Growth Vault.

The choice is yours.

Can I Just Skip This and Invest Directly in the U.S. Stock Market?

Of course—you can do that.

Who’s stopping you?

You can open a brokerage account today and start buying U.S. stocks immediately.

That’s what most people do.

But here’s the truth: That approach isn’t for us.

We didn’t grow our portfolios to 7 figures by buying aimlessly without research.

We know firsthand that buying stocks without due diligence is counter-productive.

It wastes time.

It wastes money.

And it increases your risk of failure.

Think about it this way:

If you were managing a multi–7 figure portfolio, would you feel comfortable blindly picking stocks without reading financial reports?

How would you know which companies are truly income-generating, reliable, and worth holding?

How would you know if a stock is undervalued or overpriced without checking the numbers?

If you want to build, manage, and sustain a meaningful stock portfolio, you can’t skip this process.

It’s not about being a “finance wizard.”

It’s about being business-minded—because investing is serious business.

Sure, it takes time to learn.

But isn’t that true for anything worthwhile?

A doctor spends years in medical school before treating patients.

An accountant studies before managing other people’s money.

Even athletes train for years before competing at the highest level.

The bottom line is this:

If you want to grow a meaningful, long-term stock portfolio, you can’t shortcut the work.

But you can shortcut the learning curve.

That’s exactly why Growth Vault exists—to give you the clear, structured approach you need to invest with confidence.

Let’s be honest with you. We’re not going to sugarcoat this.

Both KC and I have spent 10+ years learning, studying, reading, and refining our approach to value investing.

We’ve put in thousands of hours understanding how to analyse businesses, read financial statements, evaluate deals, and manage a real portfolio over the long term.

We know that sounds like a lot.

Because it is.

But here’s the good news:

You don’t have to take 10 years to get started.

You don’t have to figure it all out alone.

What if we could walk you through the entire process, step by step?

What if we could show you exactly how to build a strong, well-researched stock portfolio—from scratch?

Wouldn’t that take your confidence from 20% or 30% all the way up to 80% or 90%?

And what if you had access to our data, research, and case studies on the top 1% companies of the world?

So you could shortcut your learning curve from 2–3 years down to just a few months?

That’s exactly what we created Growth Vault to do.

If you’re serious about growing big, this is your chance to get the guidance you need—without wasting years figuring it out the hard way.

Right now, we’re inviting serious investors to join us in this Growth Vault —a complete, guided program designed to help you master value investing the practical way.

When you join us, you won’t just watch some videos and take notes.

We’ll walk side by side with you through a structured, step-by-step process to help you build your own Growth Portfolio—filled only with the world’s top 1% companies listed on the NYSE and NASDAQ.

This isn’t theory.

This is an action-focused program.

By the time you finish, you’ll have the skills, confidence, and clear strategy to choose, evaluate, and manage your own U.S. stock portfolio independently.

You won’t have to figure it out alone.

We’ll show you exactly how to do it—so you can invest smarter and grow your wealth with clarity and conviction.

Here’s a breakdown of exactly what we’ll do together:

You will get all these training materials:

The “Big Money” in Stock Investing

Five Viewpoints on Risks

The System to Build a US Stock Portfolio

Fundamentals: Investors’ Guide to Reading Financial Statements

Valuation: How Not to Overpay for these “top 1% companies”

Portfolio Management

Portfolio Allocation: Malaysia, Singapore and US Stocks

It’s a fair question—and here’s the honest answer.

By the time you finish the Growth Vault Training Modules, you’ll be transformed into a Growth Investor who knows exactly how to build and manage a portfolio of the world’s top 1% companies—independently and confidently.

But you might still wonder:

“Will it take me hours every day to sit and study these annual reports from scratch?”

I completely understand why you'd ask that.

Because honestly? That’s what I did—and still do.

Because those hours have always been worth it.

But what if you didn’t have to start from zero?

What if you could skip the hardest part and get:

✅ Clear guidance on what to look for

✅ Proven shortcuts to evaluating companies

✅ Ready-to-use data, research, and case studies

What if you could get all of that—so you could invest smarter with much less time?

You will get a stock list of the best companies in our watch list.

Would that save you enormous amount of time as you are leveraging on my ongoing compilation works of key financial data and my write-ups on these stocks via my handcrafted notes?

You’ll find out a stock’s long-term track record of delivering consistent growth in profitability and maintaining financial stability They include figures namely, sales, net income, long-term debt and calculation of ROE over the last 10 years.

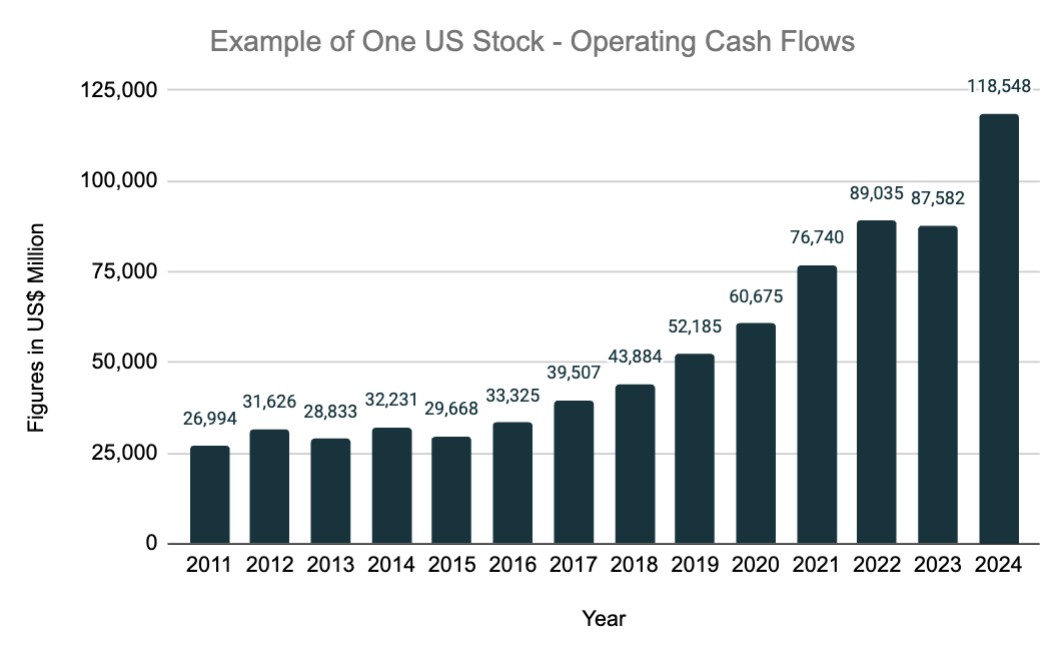

You can assess a stock’s ability to generate operating cash flows consistently from its businesses. If a stock is able to do so, it would be able to invest for future growth and pay out dividends to its shareholders consistently over the long-term.

This is where you’ll be given a breakdown of a stock’s revenue and profits from each of its key business segments. This would allow you to know which of its business segments contribute the most to the stock financially.

I compile at least 5 years’ worth of quarterly results for each stock. This allows you to assess if a stock has delivered consistent growth in sales and profits on a quarterly basis.

I’ve prepared a table of past historical valuation ratios so that you can compare them with a stock’s current valuation ratio to determine if a stock is truly undervalued, fairly valued or overvalued at its current prices.

A Simple Framework to Analyse Any Stock Like a Pro—Even If You’re Not a Financial Analyst.

My Summarised Notes aren’t just generic reports.

They’re carefully structured, handcrafted guides that help you evaluate any stock deal step by step, from scratch.

We’ve broken down each note into 4 easy-to-understand parts:

B: Business

How does the company make money?

What’s its business model?

Revenue segments, product categories, geographical coverage.

F: Finance

Profitability trends over time.

Revenue, margins, and balance sheet strength.

Capital allocation over 10+ years.

Latest quarterly results.

G: Growth

Future growth plan.

Capital expenditures (CAPEX).

Management’s strategy for expansion.

V: Valuation

P/E Ratio, PEG Ratio, and P/OCF Ratio.

Comparison with historical valuation ranges.

Helps you see if a stock is cheap or overpriced.

When you follow this B-F-G-V approach, you’ll know exactly what to look for in a business and how to evaluate it confidently.

This isn’t about relying on tips, rumours, or broker reports.

It’s about building real investing skills that let you select the top 1% companies on the NYSE and NASDAQ—without guesswork.

If you’re ready to learn this proven approach, join us in Growth Vault.

You’ll get these Summarised Notes plus 31+ real-world financial spreadsheets in our Private Members’ Area—so you can start investing smarter from day one.

Get Immediate Access to Our Entire Back Catalogue, Plus Join Us Live Every Month.

Inside Growth Vault, you don’t just get static lessons—you get real, practical, monthly case studies where we analyse top 1% companies together.

Since January 2024, we’ve been hosting one new live webinar every single month, each focused on a different high-quality company listed on the NYSE or NASDAQ.

As a member, you get:

✅ Immediate Access to All Past Recordings

2024 and 2025 sessions already in the vault.

Watch at your own pace, on your own time.

Learn how we analyse real companies like Berkshire Hathaway, Apple, Starbucks, JPMorgan, and many more.

✅ Join Us Live Every Month

Participate in a brand-new case study each month.

Watch us break down a company’s business, finances, growth, and valuation live.

Learn exactly how to do your own analysis by watching us do it.

✅ Interactive, Not Just Passive

Ask questions during the live session.

Share your own thoughts and insights.

Mingle and connect with other Growth Vault members who take investing seriously.

✅ Can’t Make It Live? No Problem.

Every webinar is recorded.

Get access to the replay, slides, and downloadable resources, as long as you are a paid member of Growth Vault.

Review the lessons as many times as you want.

You learn by seeing the entire process in action—not just theory.

You’ll see exactly how to:

Apply our B-F-G-V framework to real companies.

Evaluate their strengths, weaknesses, and growth potential.

Decide whether it’s worth buying, holding, or avoiding.

Instead of second-guessing or relying on tips and rumors, you’ll build the confidence and skill to evaluate any stock deal independently.

If you’re ready to learn the art of value investing step by step, and get the hands-on, real-world practice that actually makes you better—these monthly case studies are your shortcut.

Growth Vault Membership is RM 1788 / year — A Fraction of Typical Workshop Fees.

We know you might be wondering if this is worth it.

Here’s some perspective:

Today, attending a typical 1-2 day investing workshop in Malaysia can cost you RM 5,000–10,000.

And after those few days?

Most people leave overwhelmed or unsure where to start.

As investors, KC and I know that real mastery takes time.

No one becomes an expert in 3 days.

You need a structured, step-by-step approach you can revisit whenever you want.

That’s exactly why we built Growth Vault.

✅ It’s not a rushed crash course.

✅ It’s your long-term learning companion.

✅ Designed to help you build your growth portfolio confidently, at your own pace.

✅ Priced at a fraction of what you'd pay for one short workshop.

More importantly, once you learn these skills, you keep them for life.

They don’t expire when the weekend ends.

You’ll know how to:

Identify great businesses.

Evaluate them rigorously.

Invest in them with confidence.

Grow your wealth steadily over the years.

If you’re reading this, it shows you’re serious about investing in yourself.

That’s exactly the kind of member we want in Growth Vault.

We want to see you succeed.

We want you to use these lessons to build a world-class portfolio and improve your financial future.

So if you're ready to invest in yourself today, we’d be honoured to invest in you too.

First, I want you to know that joining Growth Vault is 100% risk-free.

We offer a no-questions-asked 30-day money-back guarantee.

If, during your first 30 days of membership, you decide it's not the right fit for you, simply email us at [email protected].

We'll issue a full refund promptly.

We typically process refunds within 24 hours.

(If there's a delay during major holidays like Chinese New Year or Christmas, thanks in advance for your patience—we'll still get it done.)

Your cancellation will be honoured based on the date of your email.

Just make sure you request it within 30 days to guarantee you don’t pay a single cent if you’re not satisfied.

That’s our Guarantee #1—so you can try Growth Vault with total peace of mind.

Lock in the Fee you Pay NOW for Life. No Hidden Price Hikes. Ever.

When you join Growth Vault at this special price during this round, you’re guaranteed this price for as long as you stay subscribed.

That means:

No future price increases.

No surprises on your bill.

No “Netflix-style” hikes on loyal customers.

Unlike most subscriptions (Netflix, Apple iCloud, YouTube Premium, and nearly every other service) that reward loyalty with price hikes, we do the opposite.

We reward your commitment with a locked-in, unchanging fee.

Your membership will always renew at the same price per year—guaranteed.

How does it work?

Your subscription is on auto-renewal for your convenience.

If you ever want to cancel, just email us at [email protected]. You can even cancel it in the members' dashboard.

We’ll stop the billing before the next cycle.

No hassle, no questions asked.

This is our promise to you: we want you focused on growing your portfolio, not worrying about rising costs.

This is where it gets really interesting.

We’re not just selling you another membership.

We’re on a mission to help you become a serious, successful investor—someone who can confidently build a first-class U.S. stock portfolio filled with some of the best companies in the world.

Our Goal?

We want you to do more than just make some money.

We want to help you grow your wealth consistently over time.

That’s why we’re making you this bold promise:

If, after following our program for 3 years, your U.S. stock portfolio is down in value—we’ll refund your entire membership fee.

Why can we offer this?

We know our approach is built on time-tested investing principles.

We believe that if you apply what you learn, you’ll own quality companies that grow over time.

We’re not here for hype, quick trades, or empty promises—just solid, reliable results.

How does it work?

Follow the Growth Vault training and build your portfolio over 3 years.

If your portfolio value is lower than when you started—even after that long-term effort—simply show us your negative results.

We’ll give you a full refund.

That’s how much faith we have in the process, and in you.

This is us putting our money where our mouth is.

Because your success is our best proof that Growth Vault works.

Here’s exactly what you’ll do to qualify for our 3-Year Full Refund Guarantee:

1️⃣ Watch and Learn

Start by going through the tutorial videos inside the Growth Vault membership.

These lessons will give you the practical knowledge you need to evaluate and choose companies from our 30+ top 1% stocks.

2️⃣ Build Your Portfolio with 5 Companies

Choose any 5 companies from our curated list that meet these criteria:

Solid Fundamentals: Demonstrated growth in sales, profits, and strong operating cash flows.

Reasonable Valuation: P/E Ratio not more than 28 and close to long-term historical averages.

Minimum Holding Period: 3 years.

3️⃣ Hold for 3 Years

If you purchase and hold these 5 stocks for 3 years—and your combined portfolio shows a loss in capital value at the end of that time—we’ll give you a full refund of your Growth Vault membership fee.

Even if it’s just a RM1 loss, you’ll qualify for the full refund.

Important:

Please keep your brokerage statements or records as proof of your investments. This ensures transparency and lets us validate your results if you request the refund.

Our goal is simple:

We want you to apply what you learn and see your wealth grow confidently over time.

For instance, if you join the membership on 31/3/2025 and invested RM 100k into the 5 stocks as follows:

3 years after 5/5/2024 (the purchase of the fifth stock), you continue to hold the 5 stocks and attain the following capital gains / losses (excluding dividends):

The market value of the 5 stocks is RM 70k, which is 30% below your investment of RM 100k.

You can submit the statements to us, proving that you bought and held onto these 5 stocks for 3 years and we would refund you all of the membership fees paid for Growth Vault. That would be RM 7,152.

Let’s say you bought Stock A on 30/4/2025 and decided to sell it off on 5/1/2026 (holding period <3 years), that stock would not be eligible for the full refund. Why? This is because we’re promoting long-term stock ownership as a means to compound net worth. Remember: We are long-term stock investors, not short-term stock traders.

Imagine this for a moment:

No more restless nights worrying about whether you're doing enough for your family's future.

No more guessing games with your investments.

Instead, you have a solid portfolio of world-class companies quietly growing your wealth year after year.

Picture sitting down with your spouse over a cup of coffee, talking confidently about your financial plans—not with anxiety, but with genuine excitement for what’s ahead.

Imagine telling your kids about the shares you own in companies they know and love. Showing them what it means to be smart with money.

Leaving them a legacy that isn’t just about ringgit and sen, but about wisdom and security.

This isn’t just about making money. It’s about freedom.

It’s about knowing your hard work will keep paying you back long after you clock out for the last time.

It’s about giving your family the security they deserve—and the opportunities you may have only dreamed about.

We built Growth Vault for this reason alone: to help everyday Malaysians grow their wealth with clarity, discipline, and confidence.

We don’t want you to just join Growth Vault. We want you to transform because of it.

That’s why we back it up with:

A 30-day no-questions-asked refund—because you deserve to try it risk-free.

A fixed subscription fee for life—so you’re never punished for being loyal.

And our extraordinary 3-year performance guarantee—if your portfolio of 5 stocks loses money over 3 years, we’ll refund every cent of your membership fee.

We do this because we want you to win.

To see you proudly managing your own portfolio.

To see you confident, calm, and certain that you’ve done right by the people you love most.

If you’re ready to take that step, join us now.

Your future self—and your family—will thank you for it.

If you opt for payment via credit or debit card, your subscription will auto-renew on the same date the following year—no muss, no fuss. However, if you choose to pay through a bank transfer, auto-renewal isn't an option. You'll need to manually send in your payment when it's time to renew for the next year. 🔄💳

Feel free to cancel whenever you want. If you pull the plug within the first 30 days, you'll get a full refund, no questions asked. Decide to cancel after the 30-day money-back guarantee? No worries—you can still cancel at any time. The cherry on top? You'll maintain full access to the members' area until your next scheduled renewal date. 🗓️🔓

You've got two easy-peasy options:

1. The Email Route: Just shoot a quick email to [email protected] and let us know you want to cancel. No need to call or Whatsapp us. We'll send you a confirmation email, and if you don't hear back within 24 hours, just ping us again at our support page. https://KCLau.com/support/

2. Do It Yourself: Prefer to handle things on your end? Just log in at https://courses.kclau.com, click your name or picture in the top-right corner, and go to "My Account." From there, hit the "Billing" tab where you can update card details or cancel the subscription.

Heads up: Once you cancel, you will still have full access until the next billing date. You'll lose access to the content when your billing cycle ends. 🗓️✅

Well done Ian for precise analysis on Amex, the playback Amex case from every occasion on last 3 decades awesome. It helps me and many that never own stocks...

Read MoreWell done Ian for precise analysis on Amex, the playback Amex case from every occasion on last 3 decades awesome. It helps me and many that never own stocks before 2010 or during these crisis to understand what that experience during such market crashed like and how to prepare emotionally and financially for it. Ian really awesome analyst diver, take time to deep dive into case study, really help me open up another horizon of my perspective. How quality and fundamental stock able to take challenges and crisis yet stay stronger after tornado or market crashed. Thanks Ian & KC.

Read LessI am enjoying the training by Ian. The lessons make sense and it is simple! Keep it up!

I am enjoying the training by Ian. The lessons make sense and it is simple! Keep it up!

Read Less